Last Updated on September 18, 2023 by swisswatchreview

Insurance is often one of those things that people do not think they need until they need it. There are a range of policies now available that offer protection for both renters and those who own their homes as well as drivers and boat owners. Some people who collect and buy expensive luxury watches assume that they already have coverage through another policy. However, those policies often limit how much the owner can claim and what they cover.

Hodinkee Insurance offers a new alternative just for watch owners. The founders worked with Chubb, which is one of the ultimate insurance providers in the world for collectors. Anyone who wants to buy coverage can apply online and get an instant quote. They get full coverage both at home and when they travel with their watches. This Hodinkee Insurance review looks at the basics of how the company works, what it costs, and other things that prospective customers need to know before they insure their watches.

Hodinkee Watch Insurance – How Does it Work?

Hodinkee Insurance works in the same way that any other insurance policy does, but it makes things easier for watch collectors and owners. Watch owners usually need to contact their renter’s or homeowner’s insurer and request that they add their watches to their policy. This will often increase the cost of their premiums. Some insurers may even refuse to cover expensive watches. Those that do ask for proof of the watch’s value. Hodinkee offers a faster and easier way for watch lovers to get the protection they need.

It starts when the customer clicks on the “Get Started” button on the insurer’s website. This lets them sign up for a free account. They need to select a username and a password of at least eight characters. Hodinkee also asks for their first and last names. Once they sign up, they can take photos of all of their watches and upload them to the site. Hodinkee never requires that users sign up right away.

Hodinkee has an app that makes things even easier. A new user takes a few photos of each watch they want to cover. The photos should show the brand name and any other pertinent information as well as any damage or condition issues. Hodinkee also asks them to add a value for each watch. This value should cover the current market value or what it would cost to replace it.

In most cases, it only takes a few seconds for the insurer to provide a quote for coverage. If the buyer agrees, they can add a credit card and pay for the insurance policy. Hodinkee promises instant coverage. Once the company receives its payment, it will cover any watches the customer added.

Hodinkee also allows visitors to use the site and app to keep track of their watches. They can sign up for a free account and upload photos of their watches and any important information about them. Those who already have an account can use their uploaded photos to get coverage later. Having an account also allows customers to insure any watches they buy later as long as they add them to their policy.

Insurers usually require that customers provide proof of value when they insure an item and file a claim. Hodinkee asks for an initial valuation when someone signs up but will then keep track of its value later. Customers receive coverage for 150% of the value of each watch. If they own a $5,000 watch and someone steals it, Hodinkee will give them $7,500 when it processes the claim. If the watch’s price rises in the future, the insurer will automatically adjust the amount due. Someone might insure a watch that’s worth $1,000 and see its value rise to $2,000 in the future. Hodinkee will always use market rates to determine how much a customer receives.

Hodinkee Insurance only requires proof of value if the watch is worth $100,000 or more. While some may submit an invoice that shows what they paid for an expensive watch, it’s common for prices to jump after they buy. Hodinkee allows customers to submit an appraisal to show that the watch is now worth a higher amount.

How Much is Hodinkee Watch Insurance?

Many people want to know how much it costs to buy Hodinkee Insurance. It’s not always easy to list an amount because each person may receive different offers. Hodinkee uses multiple factors when deciding whether to cover a watch or a user. One of the main factors is the value of the watch. For example, a Patek Philippe 5172G is one of the most expensive watches in the world. The company charges an average of around $900 a year to insure it. Cartier and Rolex watches usually cost $200 to $300 per year to insure because they cost so much to replace. Covering a cheaper watch like one from Omega or Tudor will often cost less than $100 per year.

Another factor that affects the cost is the location of the customer. New York, San Francisco, Detroit, Miami, and Philadelphia are among the cities with the highest insurance rates. Customers pay more for policies in those areas because they have a high risk of filing a claim. If Hodinkee believes that the customer has a high-risk rate, it will charge more to insure their watches.

Hodinkee Insurance customers can save money with one of the available discounts. Once they add enough watches to their account that the value of the collection hits $200,000, the site will present them with a series of eight questions. Those questions determine which – if any – of the discounts they can apply to their accounts. Those with certain types of home safes qualify for a discount. The safe must have a TRTL-30 rating, which shows that it will resist break-in attempts made with tools and other supplies for a minimum of 30 minutes. Hodinkee Insurance requires proof that the user has this type of safe installed in their home.

Hodinkee Insurance Claim – Process, Approvals & More

The Hodinkee Insurance claim process is similar to the methods that other insurers use. For claims that involve theft or burglary, the customer should file a police report. The report will include details about the incident such as the time and date when it happened and whether the thief took anything else. They may also need an invoice, appraisal, or another document that shows the individual owned the watch.

Hodinkee gives customers two ways to file a claim: online or over the phone 24/7. The online system asks them questions about what happened and whether it affected all watches or just a select few. A rep for the insurer will reach out within six hours or less. Those who call reach an automated system that asks them the same questions before they speak to a rep.

For claims involving damaged watches, Hodinkee Insurance asks the customer to talk with a rep about what they need. They usually get a check in around 48 hours that will cover the cost of fixing the watch. Customers do not need to use a specific repair shop because once they get their check, they can use it to pay for repairs anywhere they want. Filing a claim also requires the individual’s account/policy number.

Should You Insure a Rolex Watch?

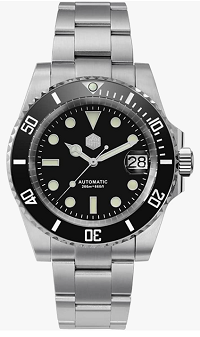

Owning a Rolex watch is an accomplishment. Though many people dream of owning one of these luxury watches, not everyone gets to make their dream a reality. Prices start around $6,500 and can rise to $75,000 or more. Even used Rolex watches are worth a lot of money. A homeowner’s or renter’s policy may only offer a total of $5,000 in coverage, which isn’t enough to cover the losses after a burglary. Hodinkee offers a good solution for anyone who wants to insure a Rolex.

One reason to insure this type of watch is that it covers the Rolex both at home and away from home. Collectors often like to travel. They might wear the watch to stand out at a professional conference or when they want to make an impression during a client meeting. They can even wear their watches when they go out for special dinners or take vacations. Hodinkee policies cover both thefts and loss that occurs when someone misplaces their watch or a thief breaks into their home or hotel room.

Insuring a Rolex also gives the collector coverage that pays for certain types of damage. Hodinkee only pays for damage that affects the way the watch functions. This can include water that gets inside the case, a stuck bezel, broken crowns, and hands that stop moving. Policies do not cover damage that occurs due to a lack of maintenance or general wear and tear.

Is Hodinkee Insurance Worth It?

For most watch collectors, Hodinkee Insurance is worth the price. Anyone can create an account and upload some details about their collection to get a quote in minutes or less. When they file a claim, the company pays them 150% of the watch’s current market value, which might be much higher than it was when the customer signed up. All policies are valid for an entire year. Prices start at less than $100 and changed based on factors like where the customer lives and what their watch is worth. Hodinkee Insurance is a solid alternative for watch collectors who want to insure one or more watches without going through a homeowner’s or renter’s insurance company.